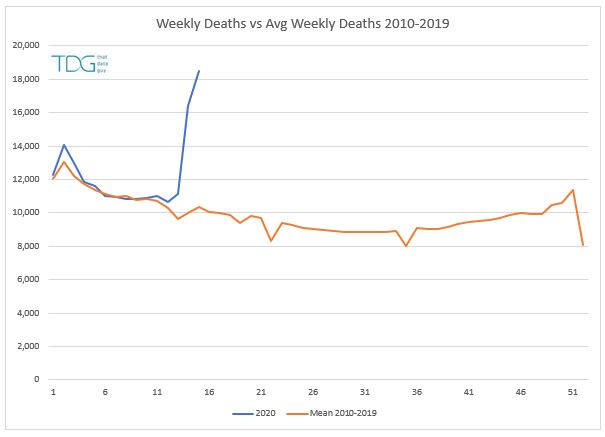

I've been watching the plateau in the UK data for some weeks now and am eagerly awaiting the point at which the numbers will start to decline. So far we seem to be holding steady, which seems a little counter intuitive given everything that's going on.

However, we need to consider what is beneath the data, whilst I've been modelling the country as a whole, given the reduced amount of movement and human interaction it may be more meaningful to examine local areas since these will function more like isolated sub-populations which might be experiencing a different dynamic to the national aggregate picture.

Sourcing sub-national data is not as easy as I had hoped. There is data for England available

here but the data tails off dramatically in the recent days and looks to report the data on the day the sample was taken (as opposed to reported as a new case) so it's not ideal, but in the absence of anything else this is where I started, but it does mean the latest day with reasonable looking data is 10th April - which is quite old given the current changes happening on a daily basis.

The first thing was to look at the data in classic English regions in terms of new cases per day per region (charts below). This was quite difficult to read because of the pronounced dips at the weekends and the general spikiness of the data (upper chart). Hence a second version was produced using a rolling seven day average (lower chart). Here we can see a few different patterns emerging, from London and the West Midland which appears to have peaked, to East of England which is flat to South West and South East which are still growing.

The net effect of this (some growing, some flat, some declining) is that overall level appears to be flat (see the stacked chart below), although underneath this headline we are starting to see some good trends emerging in some regions.

Looking into the data in more detail and incorporating population estimates (to give cases per 100K of the population) gives the chart below. This shows the weekly growth in new cases on the x-axis and number of new cases per 100K of the population on the y-axis by region. (Weekly growth compares new cases in week ending 10th April with week ending 3rd April).

Regions towards the left are declining, those to the right are still growing. Of particular concern here is the North East with high levels of infection (77 per 100K) and high growth 47%. Although, by way of balance, I should point out that these are very similar figures to those obtained for London one week earlier, so the situation here might have turned around already, but we wont know until the data catches up.

Drilling down to the next level (so-called 'Areas') gives a fairly unhelpful view of England (see below) where the grey bars show the national averages at the time of 15% growth and 47 new cases per 100K of the population. Those areas in the upper right quadrant are the areas of most concern (high infection and growing), lower left are next (low infection but growing) so could be a concern in a short while, whereas the left quadrants are flat to declining off a high base (upper) and low base (lower) respectively. It's worth noting that the lower left quadrant could represent a higher risk of reinfection in the future, but at the moment it's too early to tell.

With several hundred points we can see most permutations of growth and new cases per 100K population are occurring, but beyond that this kind of chart is not always that useful. So, instead let's examine the data in a different way. It's worth noting at this point that the reporting Areas used in the data are very different in size with some large counties having a population over a million and some reporting towns being in the 100,000 to 200,000 range, so comparing absolute numbers should be carried out with care.

By locking the chart axes we can now look at each region in turn and apply some simple 3 by 3 segmentation to the areas concerned to gain a better understanding.

So in alphabetical order, let us first look at East Midlands. This is mostly showing low infection rates with a mix of decline and growth with the only possible areas of high concern being Leicester and Nottingham. In general, this represent a good outlook for the next few weeks.

East of England - more mixed than East Midlands with concerns in Bedford and Luton now and possibly in Norfolk shortly.

London is showing good signs of recovery almost everywhere, with plenty of reporting areas with declining rates of new cases. Many areas had high level of infection (per 100K population) but seem to be headed in the right direction now. Redbridge appears to be the only standout area of London with a High-High rating.

The underlying area data shows why the North East was the outlier on the regional chart and it appears that almost all areas show high level of infection and growth. There may be an underlying demographic reason here (high level of deprivation and smoking), irrespective of the cause, the data looks like new cases may grow for some time yet and put the local NHS resources under a very high strain.

The North West has many areas in the High-High segments - similar to the North East there may be demographics underlying the numbers, but this case load and growth will continue to put pressure on the local NHS in the short term.

The South East data is spread around several segments with Kent and Medway being causes for concern along with Oxfordshire. Portsmouth may be a potential growth area in the coming weeks. Interestingly the Isle of Wight has a very low incidence of cases which I assume is related to it's separation from the mainland.

The South West has seen fewer cases than most regions of the UK, however high growth in new cases in eight different areas might suggest a delayed peak of cases in the next few weeks.

West Midlands - showing signs of recovery after being an early centre of infection during the outbreak. Most areas are now flat or declining.

Most areas of Yorkshire and the Humber and seeing below average levels of infection, many areas are seeing declining case levels, but there may be potential issues in some areas with Hull having the second highest week on week growth rate in England.

Overall it appears that the local areas of England are far from being in the same position in the infection lifecycle - while it is heartening to see large parts of the country (including most of London) in decline there is still plenty of areas (such as the North East and North West) that are yet to turn around and a large number of localities that could well peak in the coming weeks.

This localised time-lag effect probably explains some of the number behind the elongated plateau that we see at national level, however hopefully as the lockdown continues to limit the changes for the infection to spread we will see many more areas move both to the left and downwards on teh chart over the coming weeks