UK:

The number of new Pillar 1 cases continues to fall, as does the daily levels of fatalities - in fact the fatality rate has fallen slightly (relative to new cases) in the last week or so. But we are still seeing 2000 new cases each day, which is a concern since only slight changes in behaviour could see these numbers start to climb again. This higher level of new cases can be seen on the cumulative chart on the left - notice how the line is still growing at a reasonable rate (although no longer straight), compare that shape with France where the equivalent line is much flatter.

If the trend continues expect daily deaths to stay at about 300 per day (on weekdays) and the Pillar 1 total deaths to reach 28,000 in about a week.

France:

The rate of new daily cases is generally low, with occasional spikes. We are regularly seeing less than a thousand new cases a day, but the short term trend is effectively flat (reminds me of South Korea which ran on stubbornly with a token amount for weeks and weeks).

The rate of daily deaths have increased of late and have been nearly twice the previous level (based on my lag probability model). Not sure if this indicates a change in the situation of a catch-up in the reporting of earlier deaths.

Expect very similar numbers in the short term with an daily average in the high two-hundreds and a cumulative value approaching 28,000 in a weeks time.

Germany:

Despite some sensationalist reporting in the press, the data from Germany is on a steady downward trend (once the impact of weekend cycles is taken into account).

The overall rate of death determined by my lag-probability model has increased in Germany (but not by as much as in France), but still the overall reported figures are low. I'm still not convinced as to how reflective these numbers are for Germany - but since I cannot find any equivalent to the ONS weekly deaths statistics for Germany comparing 2020 with previous years, that will have to remain a mystery for now.

Expect 50-90 deaths per day to be reported for the next week, bringing the total to over 8,000 by the end of the week.

Italy:

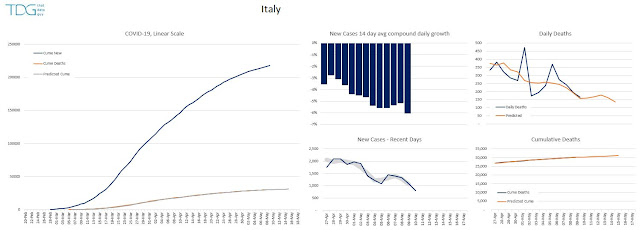

The rate of new cases is still declining steadily (now averaging a decrease of 6% per day). but as we can see in the UK, there is still some way to go with over 1000 new cases on most days in the last week.

The rate of daily deaths are following the model's predictions fairly closely, so a very predictable short term pattern appears to be emerging.

Expect daily deaths to average about 160 per day for the next week, bringing the cumulative total up 31,000.

Spain:

The number of daily new cases in Spain refuses to drop at a regular rate. Although the long term trend is downwards there have been several week long periods where the rate of new cases has been steady, and Spain appears to be in another one of these steady-periods at the moment. Hopefully, this is just a precursor to another drop in new cases in the next few days.

Expect daily deaths to average 200 per day for the immediate future with total reported deaths approaching 28,000 in about a week.

USA:

I think this is the first time I've been able to look at the US data and say with any confidence that the rate of new cases is actually decreasing. We've had some wobbles and flat-spots in the data, but now we can see a 2 to 3 week trend where the numbers are really going down. In fact I'm looking forward to updating the data by US state to see how many of the states that previously had growing rates of new cases are now flat and/or in decline.

However, despite the improvement in trend, the underlying numbers are huge with nearly 1.4 million reported cases, although many of these are milder cases than reported elsewhere, leading to a correspondingly lower rate of death (rate of death per new case after time-lag is included is approximately half that of the UK).

Now that (hopefully) many more US states are seeing declining number of new cases, in the coming weeks we should really start to see the rate of decrease start to change (upper middle chart) from the -2% value we have now to something approaching -8%, at which point the US will have really turned the corner.

Expect daily deaths to average 1700 in the next week, with total deaths approaching 90,000 by the end of the week. At the present rate a quick forecast suggests the US will record its 100,000th death on or about May 22nd, but I suspect there may well be some deceleration in the rate over the coming weeks which could push this milestone back a few days.

Post -Plateau Trends:

And finally, an update on the rate of new cases comparison for Italy, Spain and the UK. Generally we see the same trends emerging with slightly different localised rates. The periodic waves in the data are caused by lower weekend reporting (I'm working on an adjustment for this), so it's best to look at the underlying trends.